“The business of services of real estate are going to be fire! FIRE!”

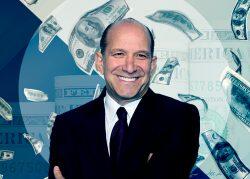

That colorful declaration didn’t come from some boisterous millennial CRE broker but from Howard Lutnick, the 62-year-old chairman of Newmark.

Some other Lutnick-isms include this one on the need for top talent and changes to the stale brokerage business:

“Do I think there are macros that need to change? With certainty… Is it going to displace people, who have that knowledge? N… F… W”

And on how banks are dealing with troubled loans:

“What happens at a bank is, if one loan defaults, oh we’ll work it out with a sponsor… if 12 loans default I’m talking to my boss and if 35 loans default, WTF?!?!!”

Lutnick spoke with his personal brand of excitement at The Real Deal’s annual Real Estate Forum on the opportunities he sees for real estate services firms in the coming years.

The Wall Street veteran often shouted out his statements, speaking in short bursts to make an emphasis. And while there was some crowd noise seeping in from the exhibition floor to compete with, one gets the perception Lutnick often talks that way to make his point.

One of the biggest areas of change he sees coming is in the banking sector. Out of some 4,000 banks across the country, Lutnick said he sees somewhere between 500 and 1,000 of them failing in the near future.

“You’re going to start seeing that in ’25 and ’26. Every single weekend a regional bank is going to go bye bye,” he predicted, adding that most of the banks will be the smaller, lesser-known ones. “The banks that default are not the banks you know.”

That should create business for firms like Newmark, he said, who will be there to help property owners find new lenders to work with. It could also benefit Newmark, specifically, which brokered the sale of Signature Bank’s $60 billion book of loans.

Newmark has a license with government agencies like the FDIC to do business with them. He took the opportunity to point out that Cushman & Wakefield, the firm from which Newmark last year poached top brokers Doug Harmon and Adam Spies, doesn’t have those licenses.

Cushman wasn’t the only competitor that got called out by name. Lutnick said Newmark is a “talent-first organization, and to illustrate his point he told a story about poaching a top broker from CBRE.

CBRE, he said, put out a statement saying that their platform is more important than any one person.

“Sensible comment. Very corporate, straight-jacket,” he said. “We put out our statement saying our people are our platform.”

Lutnick said he bought Newmark in the years following the financial crisis because he saw a long period of manufactured low interest rates that would benefit real estate. He said that while rates are high now, he sees opportunities for those with dry powder to be buyers in the next two years.

In the longer term, Lutnick said that Newmark will be rolling out some new technologies in 2027 and 2028 to help brokers, but was quick to assure them that it wouldn’t be taking their jobs.

“Think RoboCop,” he said. “Don’t think displacement.”

Read more