Aby Rosen’s RFR plans 827-unit Gowanus building

Aby Rosen’s RFR plans 827-unit Gowanus building

Trending

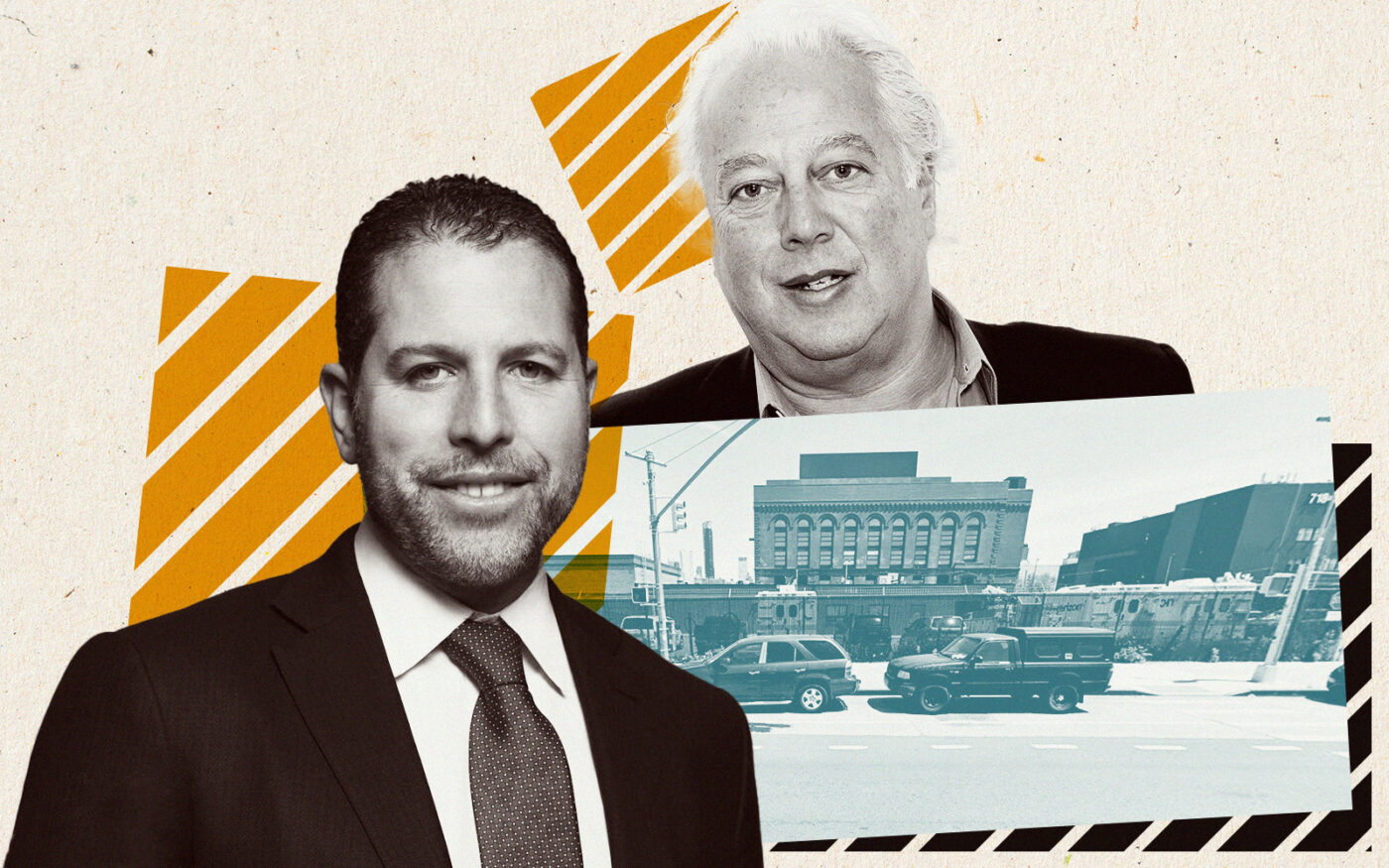

Josh Zegen’s Madison Realty Capital moves to take over Aby Rosen’s big Gowanus site

Madison Realty Capital, Maguire Capital Group to buy RFR’s distressed debt

Josh Zegen’s Madison Realty Capital has moved into position to wrest control of Aby Rosen’s huge multifamily project in Gowanus.

Rosen’s RFR defaulted on the $80 million mortgage backing its 827-unit development site at 175 Third Street, across from the neighborhood’s Whole Foods, sources told The Real Deal.

Madison Realty Capital swooped in to buy up the distressed debt and intends to foreclose on RFR’s interest in the site, the sources said.

It’s the latest sign of trouble for RFR, which has already lost a number of properties and is facing foreclosure on others. And it could shake up yet another development site in Gowanus, which has been a hotbed of activity even as multifamily construction around the city has slowed to a trickle.

Representatives for RFR and Madison Realty Capital did not immediately respond to requests for comment.

RFR financed the block-long development site with a loan from Union Labor Life Insurance Company in 2018 when it purchased the three-acre property from SL Green and Kushner Companies for $115 million.

The developer defaulted on the loan, and Union Labor tapped David Schechtman at Meridian Investment Sales to sell the note. Madison Realty Capital teamed up with Marvin Azrak’s Maguire Capital Group to purchase the debt. They have scheduled a UCC foreclosure of RFR’s interest in the property.

Madison and Maguire have partnered before. In March, they bought a distressed loan on the Fifth Avenue Hotel in Nomad.

RFR has been struggling to hold onto some of its trophy properties. It has already lost control of the Lever House and the Gramercy Park Hotel.

In March, the $104.5 million mortgage on the company’s office building at 90 Fifth Avenue was sent to special servicing, and a few days later Rialto Capital Partners said RFR failed to pay off $39 million in promissory notes last year that were part of the Signature Bank loan sale.

Rosen’s Gowanus project is one of the largest apartment developments pending in Brooklyn, but the site, abutting the Gowanus Canal, has remained dormant. Rosen’s company tried to sell the property for more than $200 million in 2019, but found no buyer.

The neighborhood was rezoned two years later, kicking off a surge of multifamily building plans ahead of the expiration of 421a.

Last month the state extended the construction completion deadline for 421a by five years, to 2031, giving new life to late-starting projects like RFR’s. But high interest rates and a tight lending environment continue to make for a challenging development market.

Read more

Aby Rosen’s RFR plans 827-unit Gowanus building

Aby Rosen’s RFR plans 827-unit Gowanus building

Aby Rosen and Michael Fuchs owe former RFR partner $20M: suit

Aby Rosen and Michael Fuchs owe former RFR partner $20M: suit

Aby Rosen’s Lincoln Road retail building hit with foreclosure lawsuit

Aby Rosen’s Lincoln Road retail building hit with foreclosure lawsuit