Yoel Goldman’s real estate career has had its highs and lows.

He built an empire throughout North Brooklyn through acquisitions and ground-up construction. He lost almost all of it in 2021 when his company, All Year Holdings, filed for bankruptcy with $1.6 billion in debt and restructuring officers kicked him out.

But Goldman managed to keep a few properties outside of All Year. Recently, he has tried to buy more real estate in Brooklyn and is attempting to make a comeback, according to court filings and sources.

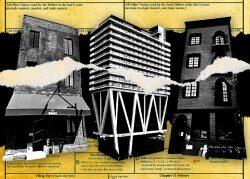

That attempt is facing setbacks. A lender recently initiated a U.C.C. foreclosure on Goldman’s interests in 394 Gates Avenue.

The development site in Bedford-Stuyvesant caught fire in 2022, leading the NYFD to send 33 crews and 138 firefighters to the building. One was sent to the hospital with minor injuries. One person was found dead in the debris, according to the New York Times.

Nearby building owners filed lawsuits against the entity owning the property. The suits alleged the landlord was responsible for the fire by failing to maintain proper fencing, working cameras or security, and by allowing the site to fall into the hands of vagrants, squatters and trespassers. None of the lawsuits named Goldman directly, but instead named an entity connected to the infamous 199 Lee Avenue address.

Read more

Goldman bought the building in 2014 for $2.4 million from a funeral home operator. He secured a $2.6 million loan from 5 Arch Funding Corp to finance the property in 2019. The lender sold the loan to KV Mortgage in April. On April 19, KV sent Goldman a default notice and said it intended to auction Goldman’s equity interests in the Brooklyn property.

Goldman filed a lawsuit to stop the sale because the auction was scheduled over Passover.

Goldman further alleged the lender never provided a pay-off letter. In an affidavit, Goldman alleged the lender received up to $1 million in insurance proceeds, which have to be used to offset the principal balance of the loan. The judge delayed the sale and a hearing is set for next month.